Finance is becoming mobile-first. Industries from retail banking to investment banking, loan origination, and insurance, are all learning to become more efficient with mobile technology. As a result, U.S. consumers can do everything from cashing a check, to investing their retirement funds, to applying for a home mortgage from the palm of their hands. Entire new technology-based segments of the finance industry, such as cryptocurrencies and non-fungible tokens (NFT’s), lend themselves naturally to a mobile experience. When properly executed, mobile banking can be cheaper, safer, and more efficient than traditional alternatives.

-

Mobile is an important strategy to Acquire customers.

34% of banked households in the U.S. used mobile banking as the primary method to access their bank account in 2019, which makes having a convenient mobile app experience an essential requirement for banks to acquire customers in today’s environment. The COVID-19 crisis has further accelerated this shift towards online banking and mobile finance. Younger customers, especially, cite an excellent mobile app as a critical feature that would make them pick a bank over factors like distance to the nearest branch and ATM density.

2. Mobile is an important strategy to Retain customers.

For both new and established customers, an incredible app experience can be an important way for financial institutions, (both traditional and fintech startups), to retain customers. Once customers get comfortable with an app, they will not want to leave. Furthermore, the symbiosis between different integrated apps and services makes switching difficult and prejudices customers to stay. For instance, if your bank’s mobile app automatically syncs with your online loan company, your budgeting application, and your payroll provider, changing banks can throw a wrench into your entire curated experience.

3. The possibilities, options, and competition on mobile are exploding.

New asset classes, like the array of cryptocurrencies and NFT’S, cannot be managed in traditional financial institutions and give credence to the idea that computers can run assets outside of traditional financial institutions. As crypto has grown from a niche product to something more mainstream, the number of ancillary business and apps, such as wallets, have exploded. Additionally, as more and more cases of fraud and mismanagement are reported – governments are cracking down on regulations, and consumers are becoming increasingly savvy about who they trust with their cryptocurrencies. To thrive in this environment, crypto- ancillary businesses will need to operate flawlessly from a trust, liability, and customer service perspective.

The market for NFT’s surged to $2.5 billion in 2021. People are showing interest in a brand of investing that looks entirely different than the traditional prestige Wall Street financial institutions. To compete, the traditional institutions need to meet the customers where they are, on their mobile devices.

4. However, it is not enough to simply have an app.

Consumers do not have a lot of tolerance for poorly designed or bug-prone apps; across industries, nearly 30% of apps downloaded are uninstalled within the first month. Moreover, when it comes to fintech apps specifically, the margin for error is likely even lower. The transactions that fintech customers are making are important, time-sensitive, and there is no room for error. Mistakes or even lags in transaction times can be devastatingly expensive. Money sent to the wrong account can be impossible to recover.

Fintech companies simply cannot afford to have bugs or mistakes in their UI. There is little room for error when dealing with critically important information and highly time sensitive transactions. The finance industry is also one of the most highly regulated industries and mistakes can leave companies open to expensive liabilities. While consumers may be willing to cut some slack for their favorite social app, they are less agreeable towards their mortgage provider. As the pace of innovation and the speed of the development cycle ramp up, it is vitally important that the fintech industry has a cheaper, more efficient, and flawless way to QA test their technology.

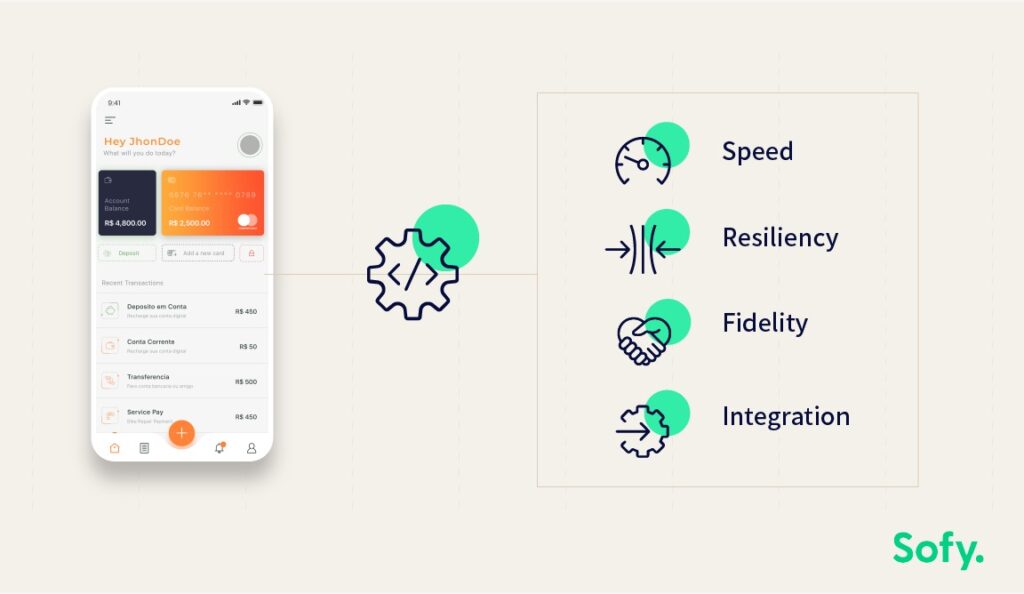

5. Here comes Sofy!

Testing with Sofy can be the solution for legacy financial institutions that are struggling to adapt to the modern environment as well as new fintech startups that are struggling to keep up with their speedy development cycle. Testing with Sofy offers the fidelity, resiliency, speed and integration needed to release great products and keep them great overtime.

-

Fidelity

With Sofy you can test your builds on hundreds of real iOS and Android devices – not emulators or simulators to ensure total fidelity between your testing environment and the real world. Whether login, accounts page or transaction details, catch the most minor bugs to ensure a kickass user experience.

-

Resiliency

Sofy’s complete AI-powered no-code automation means that you just have to create your test once and you can run it on any device or operating system without a script. Simply leverage manual testers to run automation. High-end devices or low-end devices, we have got you covered.

-

Speed

Reduce the time your team spends on QA testing by 95%. Automatic testing means, builds get validates in a few hours versus days. Moreover, you can schedule regular updates to your production environment to ensure critical services are always running.

-

Integration

Don’t waste time switching between platforms and tools. Sofy can run your tests with a command directly from within your DevOps tools and create issues in your bug tracking system. Collaborate with team, and give commands using Slack, or Teams. Upload builds from your favorite CI/CD tool or track release status using a single dashboard.

Running a finance business is hard, and keeping up with customers expectation is super critical. Sofy ensures you are delivering a superb mobile experience to your customers and your mission critical services are bug-free!